KY MAP-14 2003-2025 free printable template

Show details

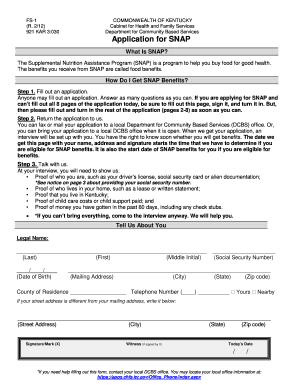

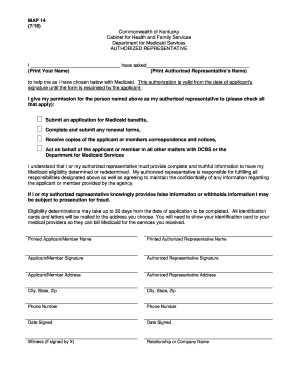

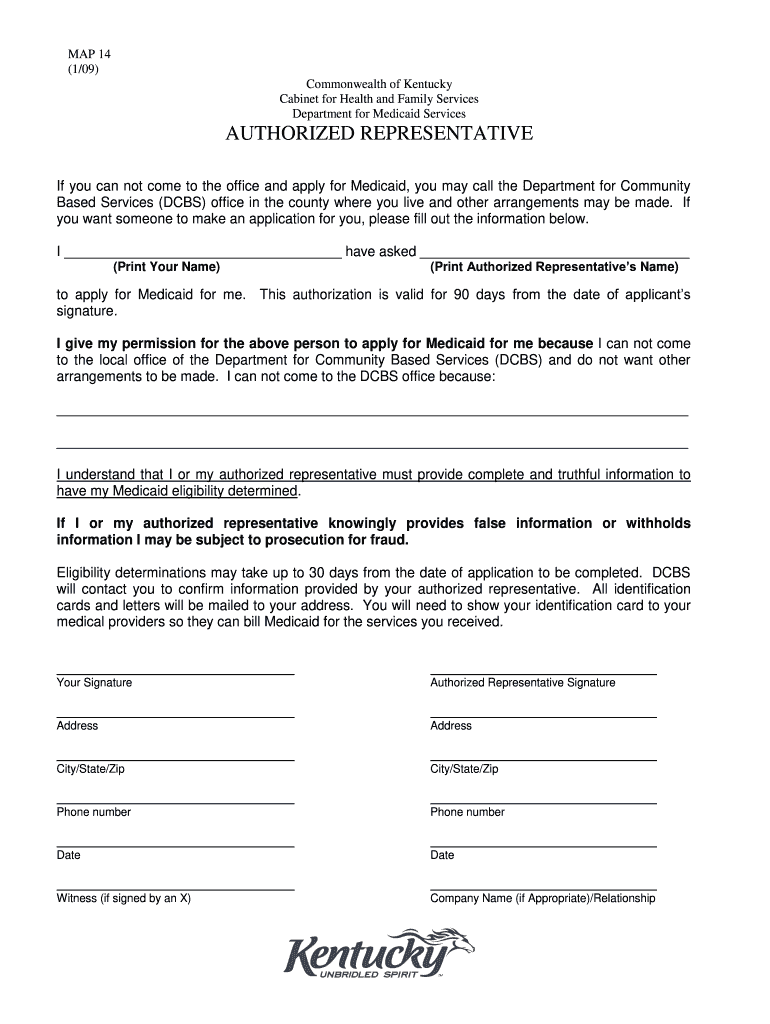

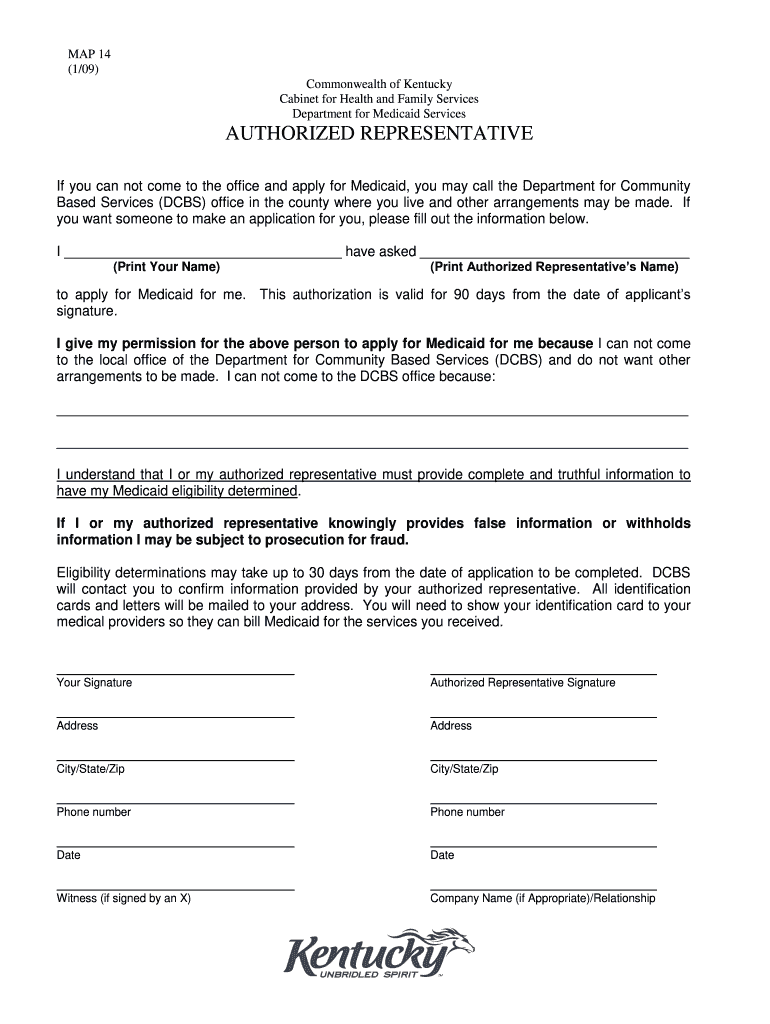

MAP 14 1/09 Commonwealth of Kentucky Cabinet for Health and Family Services Department for Medicaid Services AUTHORIZED REPRESENTATIVE If you can not come to the office and apply for Medicaid you may call the Department for Community Based Services DCBS office in the county where you live and other arrangements may be made.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ky map 14 form blank

Edit your ky map14 medicaid form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your map 14 medicaid form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit map 14 for kentucky online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit map 14 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form information

How to fill out KY MAP-14

01

Gather necessary personal information, including name, address, and contact details.

02

Obtain the KY MAP-14 form from the appropriate state agency or website.

03

Begin filling out the form by providing your basic details in the specified sections.

04

Follow instructions carefully for each section, ensuring accuracy and completeness.

05

If applicable, include information about your assets and liabilities as required.

06

Double-check the form for any errors or missing information before submission.

07

Submit the completed KY MAP-14 form to the designated agency or office.

Who needs KY MAP-14?

01

Individuals applying for Medicaid services in Kentucky.

02

Caregivers or guardians submitting on behalf of individuals needing assistance.

03

Healthcare providers assisting patients with the Medicaid application process.

Fill

kentucky map 14 form

: Try Risk Free

People Also Ask about ky applying

What is Ky Form 765?

These partnerships are required by law to file a Kentucky Partnership Income and LLET Return (Form 765). Form 765 is complementary to the federal form 1065. Forms and instructions are available at all Kentucky Taxpayer Service Centers (see page 19).

What is the Kentucky withholding tax?

Compute tax on wages using the 4.5% Kentucky flat tax rate to determine gross annual Kentucky tax. Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.

What is a Ky form?

KY File allows you to file current year Kentucky individual income tax returns and is designed to be the simple electronic equivalent of a paper form.

What is Ky Form 720 V?

Form 720-V, Electronic Filing Payment Voucher, is used by an entity filing an electronic Kentucky tax return (Form 720, 720S, 725 or 765) to pay the balance of tax due.

What is Kentucky K 4 form?

Every employee who can claim an exemption from Kentucky withholding tax must furnish their employer a signed withholding exemption certificate on Form K-4 by the start of employment.

What is a K-4 document?

Purpose of the K-4 form: A completed withholding allowance certificate will let your employer know how much Kansas income tax should be withheld from your pay on income you earn from Kansas sources. Because your tax situation may change, you may want to re-figure your withholding each year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify map14 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your ky map 14 form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make changes in kentucky map 14 form online?

The editing procedure is simple with pdfFiller. Open your kentucky map14 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I fill out ky map 14 medicaid interested authorization blank on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your kentucky map 14 medicaid interested form blank, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is KY MAP-14?

KY MAP-14 is a tax form used in Kentucky for reporting certain information related to individual income tax credits.

Who is required to file KY MAP-14?

Individuals or entities that are claiming specific tax credits in Kentucky need to file KY MAP-14.

How to fill out KY MAP-14?

To fill out KY MAP-14, complete the required sections with accurate personal and financial information, ensuring you include all relevant tax credit details.

What is the purpose of KY MAP-14?

The purpose of KY MAP-14 is to provide the Kentucky Department of Revenue with the necessary information to process and validate claims for tax credits.

What information must be reported on KY MAP-14?

KY MAP-14 requires reporting personal identification details, income information, and specifics regarding the tax credits being claimed.

Fill out your KY MAP-14 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kentucky Map 14 Authorization Form is not the form you're looking for?Search for another form here.

Keywords relevant to map 14 kentucky medicaid form

Related to kentucky map 14

If you believe that this page should be taken down, please follow our DMCA take down process

here

.